An Example of SDE vs. EBITDA vs. Adjusted EBITDA

In the last issue (#7), we discussed how SDE vs. EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) vs. Adjusted EBITDA leads to Multiples Confusion. In this issue we will help provide clarity with An Example of SDE vs. EBITDA vs. Adjusted EBITDA.

" If I were again beginning my studies, I would follow the advice of Plato and start with mathematics." Galileo

An Example of SDE vs. EBITDA vs. Adjusted EBITDA

This newsletter issue attempts to clarify why you might hear a business was sold for “6 times earnings” (without mentioning it was based on EBITDA), while yours will probably sell for only 2 – 4 times “earnings” (based on SDE, not EBITDA). The problem is when you hear “6 times earnings”, you are not hearing the definition of those earnings (EBITDA, Adjusted EBITDA or SDE). If you need a review of the acronyms, read our previous two newsletter issues, Issue #6 – How Small Businesses Are Valued Based on Seller’s Discretionary Earnings (SDE), and Issue #7 – SDE vs. EBITDA vs. Adjusted EBITDA leads to Multiples Confusion.

For the same company with the same operating results, the example below details multiples of 3.0 (based on SDE), 6.2 (based on EBITDA) and 4.5 based on Adjusted EBITDA

SDE multiple = 3.0, EBITDA multiple = 6.2, Adjusted EBITDA multiple = 4.5

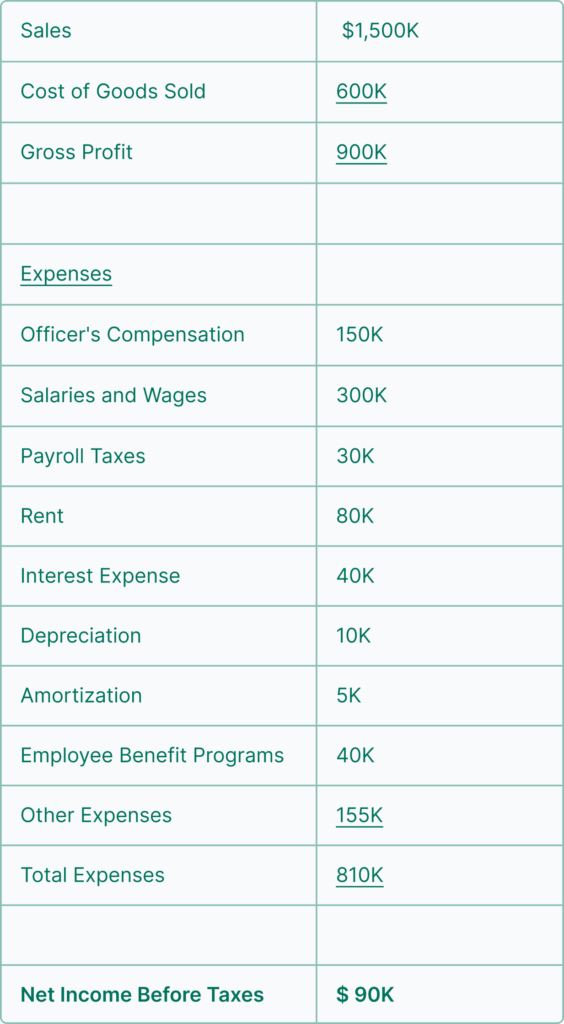

The following example is based on a company with $1,500,000 in sales and $300,000 in SDE (calculations shown below). Based on that level of “earnings” (SDE), the realistic value of the business is $900,000, which is a multiple of 3x (SDE multiplier). However, the calculations in the example below also show a multiple of 6.2x (EBITDA multiplier) and 4.5x (Adjusted EBITDA multiplier). Hopefully this example helps explain some of the confusion that arises in the marketplace regarding “multiples of earnings.”

Let’s assume the company’s tax return looks like this:

Normalizing (also called recasting) calculations (also called adjustments) to determine “earnings” are shown ….

| SDE calculation | EBITDA calculation | Adjusted EBITDA calculation (assume $100k to hire manager to replace owner) | |

| Earnings (Net Income) | $ 90K | $ 90K | $ 90K |

| Before | |||

| Interest Expense | 40K | 40K | 40K |

| Taxes | (N/A - Tax returns shows net income before taxes) | ||

| Depreciation | 10K | 10K | 10K |

| Amortization | 5K | 5K | 5K |

| Total of EBITDA | 145K | 145K | 145K |

| + Officer's Compensation (100%) | 150K | ||

| + Officer's Excess Compensation | 50K (150K - 100K) | ||

| + Owner's Health Insurance (included in Employee Benefits expense) | 5K | 5K | |

| SDE ("Earnings") | $ 300K | ||

| EBITDA ("Earnings") | $ 145K | ||

| Adjusted EBITDA ("Earnings") | $ 200K | ||

| Realistic Value of Business (based on three times SDE) | $ 900K | $ 900K | $ 900K |

| "Multiple of earnings" | 3.0x | 6.2x | 4.5x |

| SDE | EBITDA | Adjusted EBITDA | |

| (Multiple = value/earnings) | (900K/300K) | (900K/145K) | (900K/200K) |

"Multiples of earnings" based on SDE vs. EBITDA vs. Adjusted EBITDA causes confusion

If you understand the above chart, it helps clarify why business owners sometimes have misconceptions about the “multiple of earnings” they might expect when selling their business. If, on the other hand, the chart is “clear as mud” to you, it’s important to know that a great majority of small businesses sell for 1 to 3 times Seller’s Discretionary Earnings (SDE). And if you hear multiples of earnings on small business sales that exceed 4 times “earnings,” just realize that it is not an apples to apples comparison of the computation and use of the “earnings” number.

"Multiples of cash flow" also requires clarification

Another word of caution! Multiples are often expressed in terms of “cash flow” (i.e. 3x cash flow). Just as “earnings” need to be further defined for a full understanding of comparability, it’s the same with “cash flow.” It’s a generic term that can have numerous calculations/definitions. When you hear “cash flow” mentioned in conjunction with multiples and the valuation of a business, you can usually mentally substitute “earnings.” But, it still requires further clarification to determine if “cash flow” refers to EBITDA, Adjusted EBITDA or SDE. In fact, “cash flow” can have several other meanings as well. Confused? We can’t stress enough that you should always try to clarify the user’s definition of “earnings” and “cash flow.”

“If you can't measure it, you can't manage it.” Peter Drucker

Overcome the Power of Inertia

Overcome the Power of Inertia and call a business broker for a free consultation. Many brokers offer no-charge, no-obligation evaluations of small businesses. They can provide a broker opinion of value and help you identify obstacles to a successful sale as well as opportunities for improvement to increase the value of your business. That is a great way to start planning for a successful and profitable exit from your business.