EBITDA Examples

Perhaps the best way to understand EBITDA is to view an EBITDA example. EBITDA is “Earnings Before Interest, Taxes, Depreciation and Amortization. It is a measure of company earnings used to estimate the value of a business. Utilizing EBITDA provides a comparative basis to measure companies’ earnings across various industries. To value a company, a multiple is applied to EBITDA. To learn more about multiples, which average 4.0x to 6.5x for EBITDA under $10,000,000, read EBITDA Multiples by Industry.

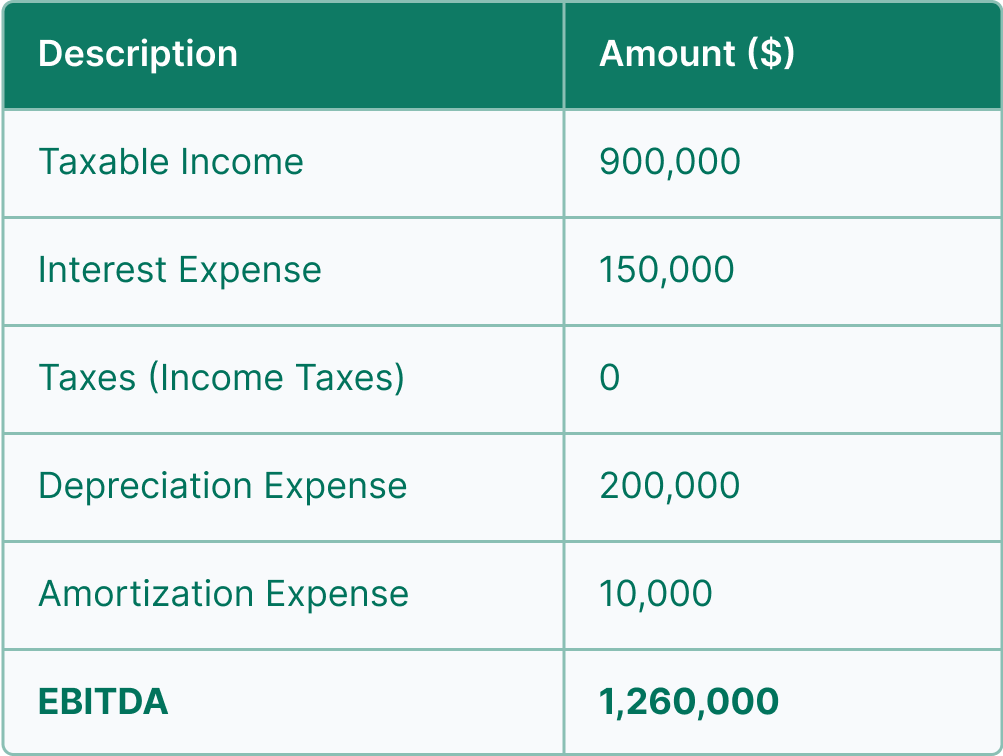

Assumptions for the EBITDA Example

Let’s assume a manufacturing business’s tax return shows $8,000,000 in revenues. Interest expense on the tax return is $150,000, depreciation is $200,000 and amortization is $5,000. The tax return also shows taxable income of $900,000, and income taxes due are $300,000. Here’s how EBITDA is computed:

EBITDA Calculation

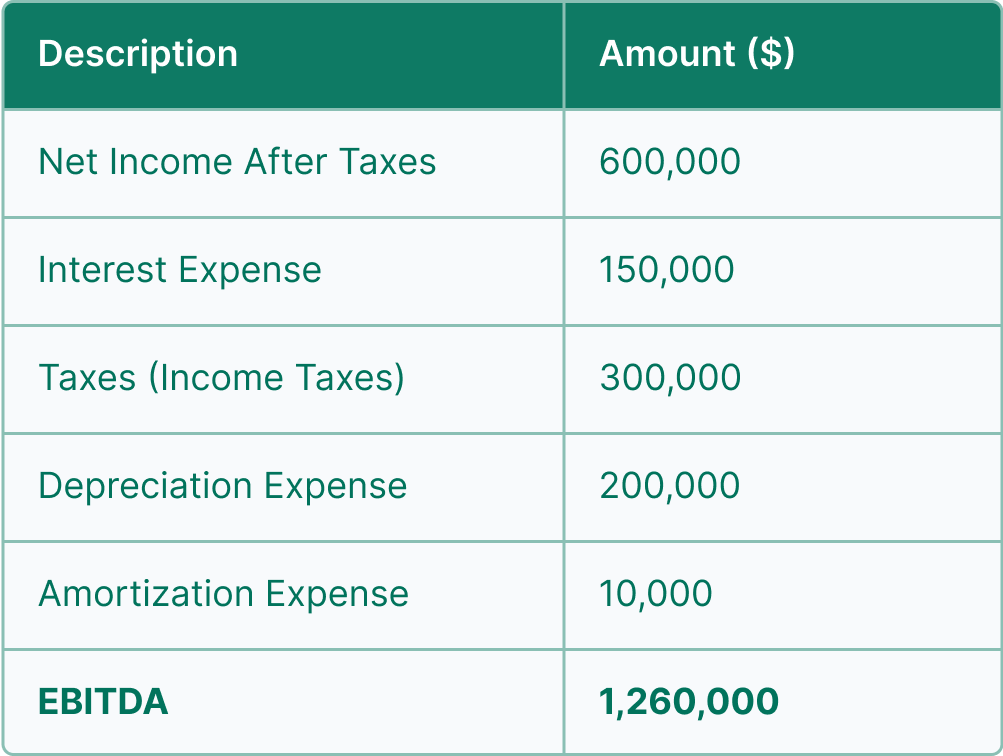

Please note that taxes have not been added back in the above analysis because we are using taxable income as the original source of earnings. By doing so, we are using an earnings number that has not yet been reduced by Income Tax Expense. Therefore, it cannot be added back. This company’s financial statements would show Net Income After Taxes of $600,000. If we were using the financial statements as the source document to compute EBITDA, it would look like this:

EBITDA Calculation

EBITDA Valuation

By referring to the EBITDA multiple chart in the article EBITDA Multiples by Industry, we might decide to apply an EBITDA multiple of 4.5x. Doing so would yield a valuation of $5,670,000 ($1,260,000 x 4.5). There are circumstances where further adjustments to EBITDA are justified before the appropriate multiple is applied. To learn more, read Adjusted EBITDA Calculation.

There’s a lot that goes into valuing a company. One of the key items in thinking about the value of a business is goodwill, and how much of the purchase price should be allocated to goodwill. You can find more out about goodwill here: How to value goodwill when selling a business