EBITDA Multiples by Industry

Determining the multiple of EBITDA (by industry) to use for company valuation can be tough. A business, really any business, there’s just a ton of variables that weigh into the EBITDA multiple that one might choose to come to company valuation whether privately held or a public company.

The number one criteria for choosing an EBITDA multiple generally speaking is going to be industry selection. IF you’re doing a business valuation for a private company based on an EBITDA multiple consider that EBITDA multiples may or may not be appropriate based on the size on the business. Note for a small business doing less than 1 mm in EBITDA a Seller’s Discretionary Earnings approach will generally be more appropriate.

Various industries generally have different EBITDA multiples because different industries have different growth prospects, financial performance, and financial metrics. I generally say, and have seen that plus or minus 10 or 20% similar companies in the same industry overall financial performance after the the top line in certain revenue brackets. Each industry will have different “brackets” with different expected EBITDA margins as a % of revenue.

For instance, in ABC industry from 1 to 2.5mm in sales the EBITDA margin will be around something like 15% whereas above say 3 up to 10mm EBITDA multiples might balloon to 20% or vice versa. The difference being is that various companies or really industries have different economies of scale or scope.

The biggest reason for the difference in business valuation between industries is going to be really 2 factors in combination: the growth rate of the industry and the incremental cost of fulfilling on those incremental sales. For instance, in a software business the incremental cost of additional sales will generally be low to negligible, meaning that as the company scales up the company’s financial performance will improve considerably once scaled up.

Compare instead to a machine shop who is at 80-90% capacity. In order to scale up this business you’d have to likely start up or buy another machine shop to create more capacity. All else equal it make sense when a prospective buyer compare companies here that the machine shop would sell for a lower multiple whereas the software business would trade for a higher EBITDA multiple.

Unlock Your Business's True Value – Free Valuation!

Discover how much your business is truly worth with our no-cost, no-obligation valuation. It’s fast and easy!

What is EBITDA?

Financial analysts typically start by looking at EBITDA to really start the valuation process for generally speaking “larger” meaning lower middle, middle, or even larger market companies. Generally speaking when buying or selling companies with EBITDA’s greater than 2.5 mm but as little as 1mm is when EBITDA is usually a useful metric to start with for company value.

It’s a useful tool to determine just generally “how profitable is this company” because it strips out a lot things that add “noise” that make it harder to compare companies.

EBITDA is an acronym for Earnings Before Interest Taxes Depreciation and Amortization. So breaking this down a little further earnings is basically the operating income from continuing operations (or if looking historically how much income after Cost of goods and overhead ((SG&A) did we clear.)

Different companies will have variances in their interest rate and debt load, their depreciation expenses, and even in the amortization schedule on their intangible assets on their balance sheet. What it doesn’t change it the operating profit.

Keep in mind now, that EBITDA is different from cash flow. Generally speaking the difference between cash flow and EBITDA is really that cash flow incorporates a few more variables here.

Specifically:

- Cash flow incorporates changes in working capital

- It incorporates CAPEX ( which in it’s essence is really how much did we invest back into the business either to grow it or maintain it.)

- In it’s essence, cash flow looks to address effectively how much cash did we generate in a given time frame.

EBITDA multiple by industry in 2021

As you may have notice so far the EBITDA multiple for your business, or a business you are looking to buy or invest in is one of a multitude of metrics that come into play when it comes to coming to a fair value of the business and the true valuation multiple.

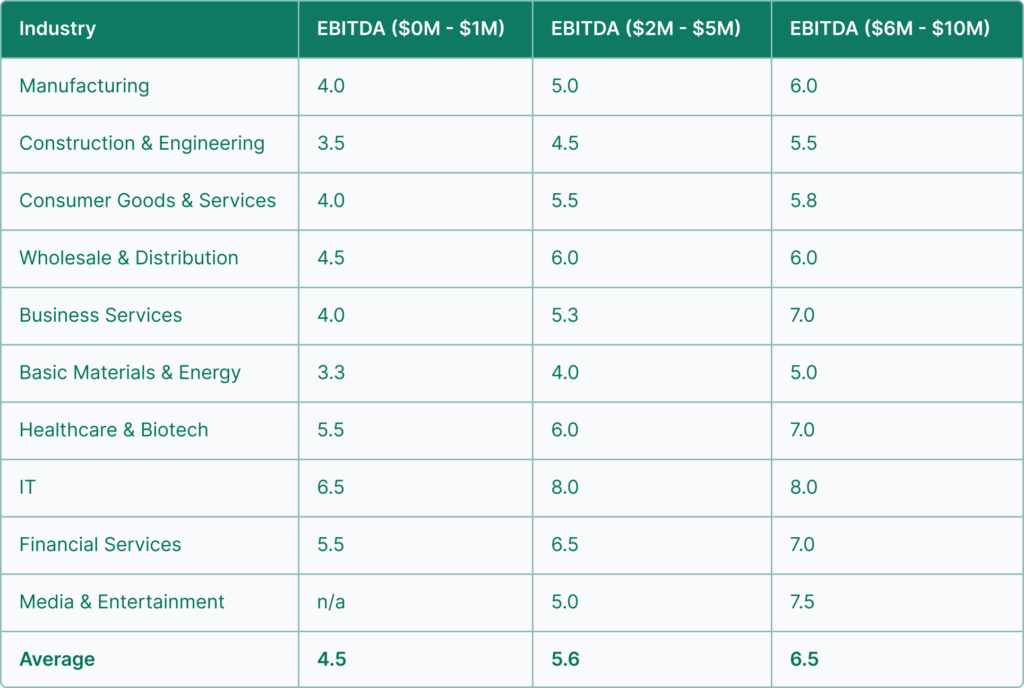

The EBITDA multiple is a useful rule of thumb but every business is different, every industry is different. Below is a useful ballpark of where companies trade for.

A couple of things to note here:

For most businesses with EBITDA of $1,000,000 – $10,000,000, the EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing as EBITDA increases. However, due to growth prospects, high tech and healthcare/biotech firms tend to earn EBITDA multiples for their industry above this average norm. Meanwhile, construction and engineering firms often have EBITDA multiples for their industry below this norm.

The 2021 Capital Markets Report produced by the Pepperdine Private Capital Markets Project (on page 49) displays a chart showing EBITDA multiples by industry and by the size of EBITDA itself.

Enterprise value (EV/EBITDA)

There is something here worth exploring a little bit further.

The EBITDA multiple chart takes into account the balance sheet when coming to the actual equity value. The business valuation table above does consider the EBITDA multiple, but the balance sheet does come into play in terms of the actual market value in privately held companies or public companies. These transactions will often times come with accompanying account receivables, cash, equipment, even debt leases or other obligations. All of these factors play into the ultimate enterprise value for the asset.

Remember the EBITDA multiple is really only a ballpark on operating income.

The equity value of the business ultimately when it comes to a transaction.

Enterprise value is really the EBITDA multiple plus or minus the net assets minus net debt. If your business has more assets than the average that should ultimate balloon the equity value and vice versa.

Financial Performance, Upside, & Risk (Factors that influence your EBITDA Multiple)

There are other factors that influence the EBITDA multiple other than industry growth prospects and upside potential (ability to scale/ profitable incremental sales.)

Risk plays perhaps as important of a role on enterprise value. The size of the business and the level of EBITDA itself plays a huge part in selecting an EBITDA multiple, with the general perception that investments in larger businesses have less risk and therefore merit higher multiples. There’s a lot of reasons for this but to name a few a bigger company typically have:

- A management team in place. Business managers there to manage the day to day of the business, whereby a prospective buyer doesn’t have to wear all the hats that they’d have to in a smaller business. In a word, bigger is better because primarily of specialization.

- A larger business typically has less concentration risk with any one client, supplier, key personnel, among other things. Relying on one of anything is, all else equal, less risky.

Bigger businesses tend to be more established companies and have a history of weathering downturns. Partly because, all else equal, they generate more profits which can help buffer a roll over in the economy.

Another, often overlooked key factor in the EBITDA multiple for prospective buyers is really centered around access to financing. When it comes to leveraging an asset, all else equal a buyer wants to borrow as cheaply as possible, for as long as possible, for as much as possible. Said another way the terms of the debt, the price (interest rate) of the debt, and the availability of the debt (or even equity) will change how much the market is willing to bear in a theoretical purchase price. All this relates to the capital structure of the deal. The more advantageous the capital stack for the buyer, all else equal, the more they are theoretically willing to pay.

(For a chart of multiples for smaller businesses, read How Small Businesses Are Valued Based on Seller’s Discretionary Earnings (SDE)).

The current economic climate, including the availability of financing, can have a considerable effect on EBITDA multiples, which will increase in a positive economic environment with low interest rates. Businesses that require a lot of working capital or significant investments in capital expenditures will earn lower EBITDA multiples. For more on this subject you can check out a more complete post here: How to value a small business for sale

Note * the difference between the EBITDA value and the tangible book value of the business is sometimes called goodwill. When a buyer buys a business this sits on the balance sheet and amortized over a number of years. For more information on what the goodwill value of your company might be check out the article: How to value goodwill when selling a business.

Unlock Your Business's True Value – Free Valuation!

Discover how much your business is truly worth with our no-cost, no-obligation valuation. It’s fast and easy!

Don’t Sell Yourself Short!

Is Your Business Worth What You Think?

Your business is your biggest asset—make sure you know its true value before making any decisions.

Get Free Valuation