Understand the process, use our interactive tool, and avoid common mistakes in SDE adjustments.

Why SDE Matters

If you’re gearing up to sell a business pulling in under ~$1 million in “profit,” chances are, what you’re really talking about is Seller’s Discretionary Earnings (SDE). Once your profit crosses into seven-figure territory, we start switching gears and discussing EBITDA instead.

But if you’re on the selling side of a small business, knowing the right financial shorthand makes a big difference. It helps you speak the buyer’s language, present your business in the best light, and avoid looking like you’re winging it.

Before we dive deep into SDE, let’s step back. Different types of investors care about different versions of “profit.”

- A bond investor (lender) mostly wants to know: “Can I get paid back?” Secondarily: “Am I being paid enough for the risk?” They usually rely on historical performance and focus heavily on EBITDA.

- Private equity players are focused on return on equity. Since they often don’t want to be in the weeds of daily operations, they prefer deals where management is already in place, and they just need to inject capital.

- Now enter your typical “mom and pop” buyer. They’re often buying themselves a job. They want something they can finance (hello, SBA loan) that earns them enough to ditch the corporate world. We’ve got at least seven buyer personas, and most fall into this camp right now.

For these buyers, the key metric isn’t some abstract notion of enterprise value. It’s: “What can I actually take home each year?”

That’s SDE.

This is the buyer’s perspective on the business. It includes the owner’s salary and any expenses that are incurred through the business and wouldn’t be carried over to a new buyer.

What’s New: We’ve added:

- A step-by-step guide to calculating SDE

- An interactive valuation tool

- A rundown of common SDE pitfalls

If you want a fast-and-dirty estimate of your business’s value, use our SDE calculator. For the full deep dive, read on. And yes, we’ve seen all sorts of creative “add-backs” from brokers that don’t quite pass the sniff test. A few things to keep in mind:

- Marketing expenses? Not an add-back if they’re tied to generating revenue.

- Rent/real estate? If you’re including the property in the sale, account for its cost properly—don’t double-dip.

Use Our SDE Calculator

Understand the process, use our interactive tool, and avoid common mistakes in SDE adjustments.

Step-by-Step SDE Calculation Guide

Why This Matters

Buyers care about what a business is earning now. Lenders care about what the business has proven. Since most deals under $1M in SDE are SBA-backed, your numbers need to be both credible and bankable.

This means:

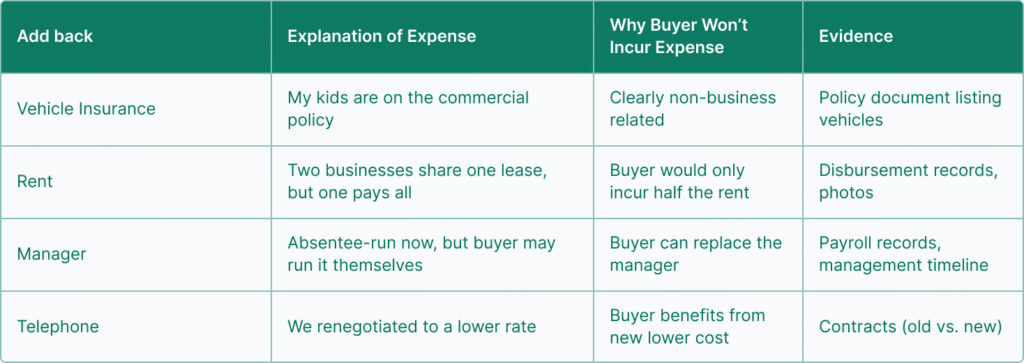

- Your add-backs should be commercially reasonable.

- You should have documentation to back them up.

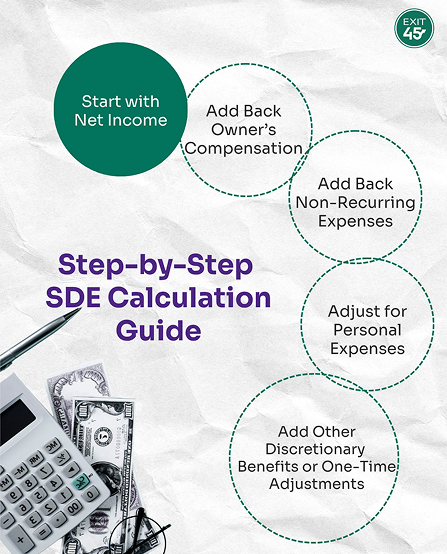

How to Calculate SDE

Your golden rule

What are the earnings of this business in the buyer’s hands, changing nothing about operations except removing me (and my personal expenses)?

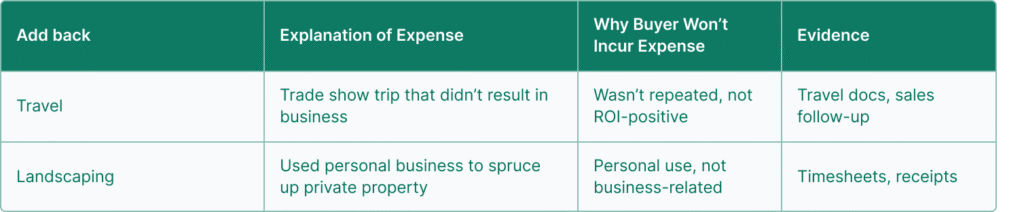

Go through every line of your expenses. Classify what’s needed to run the business and what’s not. Log the non-essential ones in a spreadsheet.

Step 1: Start with Net Income

This is your “bottom line” on the income statement. Work backwards from here to uncover add-backs.

Net Income = Revenue – Cost of Goods Sold – SG&A

Step 2: Add Back Owner’s Compensation

This includes:

- Salary

- Bonuses

- Distributions

The big question: If I’m gone tomorrow, what was I taking home that the buyer will now keep?

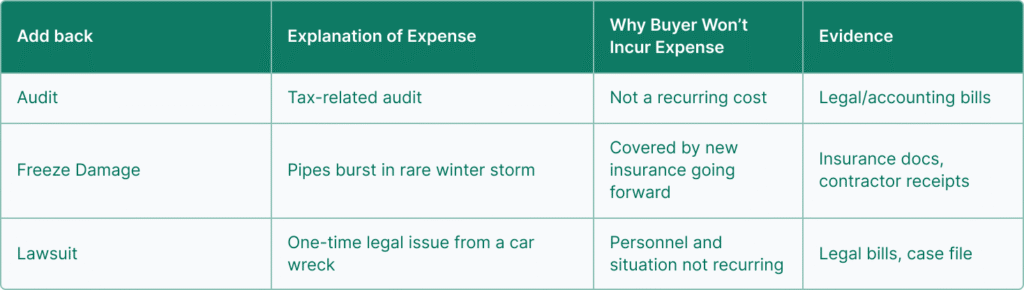

Step 3: Add Back Non-Recurring Expenses

These are expenses that won’t repeat.

This total gives you the clearest picture of what a buyer can expect to earn. It’s also what lenders will scrutinize.

Want to test this yourself?

Use our tool to quickly calculate your business’s value based on SDE.

How It Works

- Enter your net income

- Plug in owner compensation

- Add one-time expenses and personal adjustments

The tool will walk you through the logic and output your SDE. Bonus: It also gives you insight into how each component affects valuation.

Why Use It?

Because it simplifies what can be a messy, manual process. It helps:

- Sellers prep for a listing

- Buyers perform quick due diligence

Common Pitfalls in SDE Adjustments

Problem 1: Overestimating Owner Benefits

Some owners toss in everything, including their kid’s soccer dues. Don’t. Buyers (and banks) won’t buy it.

On the flip side, some sellers under-report their add-backs. Go line-by-line and ask: Would a buyer reasonably incur this cost?

Problem 2: Ignoring Non-Recurring Expenses

Legal fees, tax audits, and unique one-offs should always be flagged.

Many owners with multiple businesses funnel legal and accounting through a single entity. Make sure you expense only what’s relevant.

Problem 3: Inconsistent Reporting

Incomplete or outdated books derail deals.

If your numbers are a mess, take time to clean them up. It’ll pay off—literally.

Problem 4: Overlooking Market Conditions

COVID spikes. Texas freeze events. Restaurant shutdowns.

These macro events can distort your numbers. Be transparent. Buyers aren’t dumb, and trends are easy to spot in a 3-year P&L.

Conclusion

SDE is the single most important figure in small business valuations. Buyers care about what they’re getting now. Lenders care about what you can prove. Neither cares what you hope happens.

Now you have the tools:

- A clear step-by-step SDE process

- A valuation tool

- A guide to avoid costly mistakes