How to Value a Small Business for Sale

If you are considering selling your company, there’s nothing more important than learning how to value a small business for sale. It’s critical to understand the factors that drive a business valuation, and it’s essential to recognize that only about 20% of small businesses ever sell. Why such a low percentage? There are really two primary reasons: 1) business owners’ failure to plan for a sale; and 2) unrealistic asking prices for businesses based on the current business value. Both are within your control.

There are a number of business valuation methods:

- Liquidation value of your business

- This is functionally an asset based valuation based on the fair market value of the business assets in the business. Functionally, this quantifies what could be received in an “orderly liquidation.” Assigns no value to the “goodwill” or “blue sky” of the business. Now, generally speaking this is useful to understand so that you can establish an floor on the value of your business.

- Comps based

- Functionally a multiple of profit (sometimes revenue in CERTAIN industries) based on comparable sales for other similar businesses.

- Note: The definition of profit can lead to confusion for most businesses seller’s discretionary earnings (SDE) is generally the most appropriate. However, there are two others that sometime come into play with larger businesses when determining market value for small businesses (really more like lower middle market businesses.) These are EBITDA and Adjusted EBITDA. Keep in mind these definitions are not cash flow. These are all different terms with different multiples and different precise definitions

- Discounted cash flow method (DCF)

- When going through business school most people who did business classes that touched on business valuations most of these valuations were tied to running DCF’s based on projections of cash flow for public companies going into the future. There are a litany of problems in using DCF’s to calculate a small business value which we’ll get into here in a little bit in the article.

For Small business owners you should disregard discounted cash flow method

Of all the valuation methods DCF’s are the most inappropriate for small business owners. If you have a business appraiser talking to you about how you need to do a DCF to determine value I would run the other way.

DCF’s are commonly used in the middle market + size businesses as well as real estate. What they aim to do is discount to net present value the cash flow of the business based on current interest rates.

Discounted cash flow analysis doesn’t come in to play in the small business because small businesses aren’t appropriate for DCF’s because they aren’t valued on cash flow.

The second is that the discount rate (risk premium) that would be required to come to an appropriate valuation is nearly impossible to figure out.

The third perhaps least obvious is that while DCF’s take into account the weighted average cost of capital they don’t take into account the availability of said capital. Banks don’t generally like lending to small businesses because of the risk, and if a potential buyer can’t get access to capital at any price (interest rate) there’s no sale to be had.

What ends up happening with these models most of the time is that people try to figure out what price they want to sell the business for and just play with the model until it justifies that price.

Business valuation Process

If you’re working with a business appraiser, business valuation expert or you’re looking to sell your business and ultimately choose to work with a business broker (who will ultimately have to do their own business valuation in order to figure out just what potential buyers would be willing to pay) they’re going to have get both qualitative and quantitative data on your small business.

When we do valuations and for any professional business appraiser they’re going to need to get financial records from you. Specifically they should be collecting:

- 3 years of monthly financial statements- balance sheet and income statement (most small businesses don’t compose a cash flow statement)

- For the balance sheet they should be looking for business liabilities and tangible and intangible assets

- 3 years of tax returns

- a list of tangible assets in the business

- An aging of summary of accounts receivable and accounts payable

- A list of intangible assets (things like IP, client list size, vendor relationships etc.)

- Generally speaking a business questionnaire that will help to determine more about the qualitative aspects of the opportunity your small business presents to an investor, lender, potential buyer.

These are generally the the items that a professional appraiser absolutely needs to understand and know to begin to determine the business’s value.

Business Assets

I’m going to give you a secret that could add substantial value to your business valuation as a business owner.

The biggest component that can give you lift to the value of your business in a sale outside of improving the P&L of the business is actually going to be the intangible assets. Small business owners generally do not understand the power of their businesses intangible assets.

Note: These almost always sit outside of the financial statements. Here is a sample of some intangible assets most business owners typically overlook.

- the strength of your management team

- Processes and systems that are better than the industry average

- your distribution network (your ability to get your product or other products distributed efficiently to the market)

- your relationships with your clients

- Supplier relationships

- Cost of capital advantages

Determining business value when selling

A business worth generally speaking is determined in a large way by two primary factors. The first is the net income or really the profitability of the business. The second, often overlooked, is the ability for potential buyers to get business loans against the asset.

As the business owner, thankfully, you have control over both. If you’re planning on selling you want to get business development going to really step up the revenue and then ultimately profit of the business as this will more drive up the business valuation. Of course this takes time. If you’re looking to sell your business quickly, you may not be able to pull the levers of your business to maximize the business valuation.

The second is availability of capital. A caution to business owners if your business isn’t bankable, in other words it won’t qualify for bank lenders, you’re going to limit the number of potential buyers dramatically. In order to make sure that you’re maximizing the business valuation you’re going to need to make sure that on paper the business is packaged in such a way that will allow an underwriter to make the loan (assuming an average buyer borrowing capacity.)

The number one thing that folks do when they run their business is pushing through personal expense through the P&L and writing them off as business expenses. A bank will usually, unless you can show receipts and verify these to be true will consider those “business expenses” to be actual business expenses. What that ultimately does is weigh down on the profitability of the business from an underwriting perspective and ultimately weigh down on the amount of capital for business loans to prospective buyers.

Talk to any business broker on any given day and they’ll say basically the same thing. If you want to sell your business make sure that you’re not running unnecessary expenses through the business and if you are accepting cash make sure that you’re reporting cash receipts accurately.

I have often quipped for most small businesses the prospective buyer might be buying the business but ultimately the bank is going to write the check. Make sure that from the banks perspective that the business valuation checks out so that you can get the exit that you want.

Example - Assumptions to Value a Small Business for Sale (SDE)

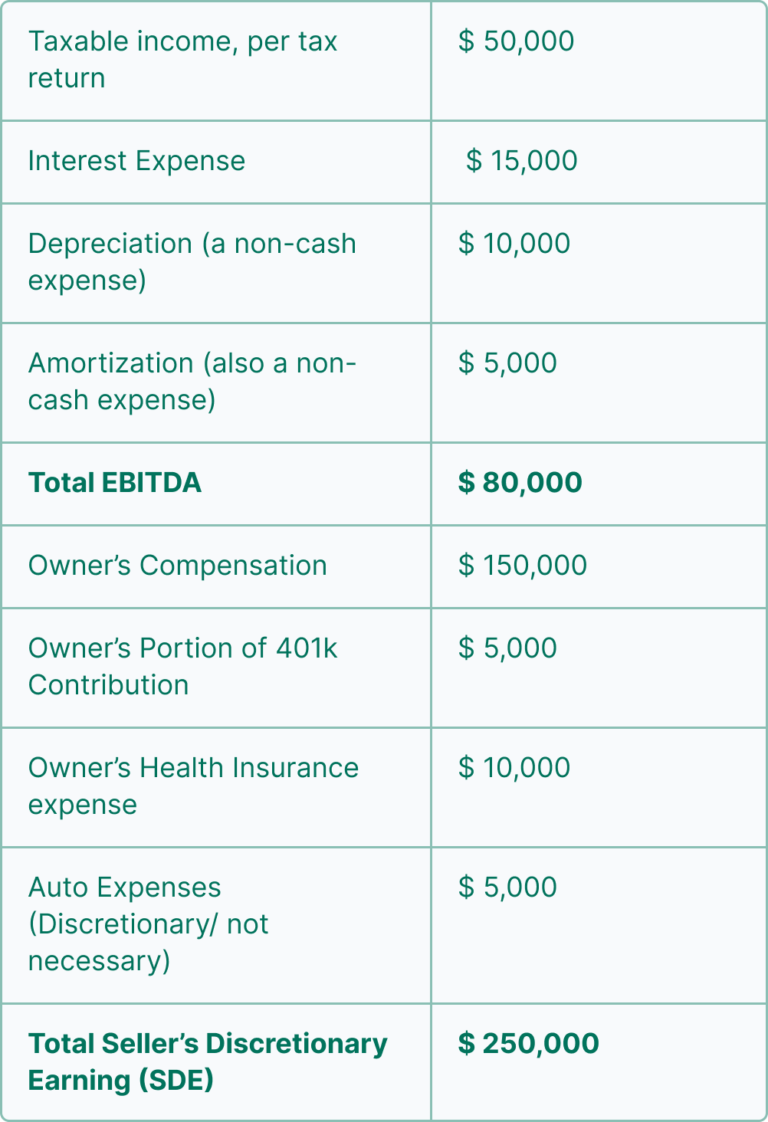

To value a small business, the first step is to determine your seller’s discretionary earnings (SDE). Then SDE is multiplied by an appropriate multiple to arrive the estimated value of the business. Let’s provide an example.

Let’s assume the tax return of a small business shows $850,000 in revenues with taxable income of $50,000. Included as expenses on the tax return are interest expense of $15,000, depreciation of $10,000 and amortization of $5,000. The Officer’s Compensation line shows $150,000. In addition, the tax return shows $20,000 on the Pension and Profit Sharing line for a 401K matching deposit (of which $5,000 was deposited into the plan for the owner’s benefit). Also, the company’s insurance expense includes $10,000 for the owner’s health insurance. And finally, the owner charged $5,000 of gasoline and car repairs for his personal vehicle to the company credit card but only uses the car for his daily commute. In other words, that $5,000 of car expenses are not really necessary expenses of the business, but they are included as expenses in the tax return.

At first blush, you might think the company is valued based on its $50,000 in taxable income. But that far understates the discretionary earnings of the business. In computing SDE, the goal is to “recast” or “normalize” the earnings so it reflects the total “owner benefits” available to a buyer of the business.

Calculating Sellers Discretionary Earnings

Based on the assumptions in the prior paragraph, here is how to calculate seller’s discretionary earnings to value that small business for sale.

How to Value the Small Business for Sale

Now that we’ve recast (or normalized) the tax return results to arrive at seller’s discretionary earnings, we need to multiply by the appropriate multiple. At this level of SDE, the appropriate multiple is about 3.0x, so the estimated value of the small service business is $750,000 ($250,000 x 3.0). To view a chart of earnings multiples based on SDE, read Newsletter Issue #6 – How Small Businesses Are Valued Based on Seller’s Discretionary Earnings (SDE).

This is a fairly simplistic example of how to value a small business for sale. For example, there are many other types of add backs or even negative adjustments to SDE that must be considered. This website devotes a substantial amount of content to business valuation issues and many of the articles explore in greater depth more complex aspects of how to value a business. To learn more, read the six newsletter articles mentioned below.

For those doing more than 1mm in EBITDA check out this article here: EBITDA multiples by industry

Pssst Looking for a business valuation?

I recommend any business owner who is considering selling their business in the next 5 years to get a business valuation done on a regular basis (once a year) if they really are trying to maximize their business valuation.

Most business owners are surprise as they are building toward their exit that ultimately they are building their business in ways that potential buyers simply would not or do not care about.

If you’ve read this far I can only assume that you’re serious about determining your businesses worth, if so we should chat.

Subscribe below and I’ll reach out to you to schedule something.