Real Estate Value too High vs. Return on Investment (ROI) When Selling a Business

In the last issue (#69) we discussed a somewhat surprising obstacle: Issue #69 – Asset Value too High vs. Return on Investment. In this issue we’ll discuss a similar obstacle: Real Estate Value too High vs. Return on Investment.

"There are lots of things in life you can't control, but how you respond to those things is the one thing you can control." Yogi Berra

Real Estate Value too High vs. Return on Investment (ROI) When Selling a Business

If the value of your business’ real estate is extremely high, due to ROI concerns, it can negatively affect the salability of the business.

In the last newsletter, we provided an example of a business owner who died after making a substantial expenditure in new equipment. As a result of that large investment, when his wife attempted to sell the business to a senior employee, the business cash flow was insufficient to provide an acceptable ROI to the prospective buyer. It is not uncommon to encounter the same type of obstacle with high-value real estate.

An example of a business that cannot be sold due to the high value of its real estate

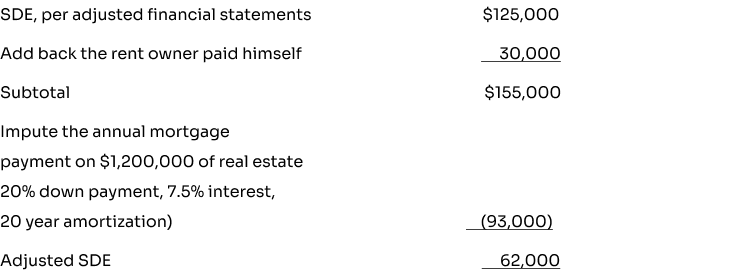

Seven years ago, John Smith personally acquired a 10,000-square-foot building on a major thoroughfare in an area that he expected would experience significant commercial and residential growth. After converting the property to an automobile collision repair shop, he had invested $400,000. Since John owned the real estate personally, he had his company pay him annual rent of $30,000 per year to cover the mortgage payment. Four years ago, John had an evaluation of his business which determined that his Seller’s Discretionary Earnings (SDE) was $125,000 after deducting the $30,000 rent expense. The business was valued at approximately $335,000 and it was assumed the real estate had a value of $450,000. Last year, Walmart built a new shopping center across the street and McDonald’s built on an adjacent lot. In the meantime, John’s business had remained steady with approximately the same level of revenues and expenses, so he assumed the SDE was still about $125,000 and the business value was still about $335,000. But as he had hoped, the real estate value had increased significantly to approximately $1,200,000. John assumed, wrongly, that he could sell the combined real estate and business for $1,535,000. Why was he wrong? The mortgage payment on the increased value of the real estate has to be factored into the computation of SDE. Here’s what that means:

At this level of SDE, the business may not even be salable. Would a buyer of the business be willing to make a $240,000 (20%) down payment on a $1,200,000 piece of real estate that requires him to work full time in a business where he may not even be able to pay himself $50,000? It is highly questionable. Despite the real estate being worth $1,200,000, the combination of selling the business and the real estate is not likely to occur at more than $1,250,000 – $1,300,000, if at all. In other words, in light of the debt service on the real estate, the business value itself is probably only $50,000 – $100,000, assuming it can be sold at all.

Consider moving the business

In reality, because the business may never sell, John may cash out sooner by just selling the real estate and closing the business. Or he could relocate the business to less valuable real estate and probably succeed in selling the business once he’s proven his customers have followed him to the new location.

I’ve personally encountered similar scenarios multiple times. In fact, one owner for whom we performed an evaluation several years ago realized that he needed to move his company out of its existing location to be able to maximize the proceeds from the sale of his real estate, and ultimately his business. By doing so, he is well on his way to setting himself up for a successful retirement.

Have you monitored the value of your Real Estate versus…..