Asset Value Too High Vs. Return on Investment (ROI) When Selling a Business

In the last issue #68, we discussed the obstacle produced by Customer Concentration Issues. In this issue we’ll provide insight into an obstacle that might surprise you: Asset Value too High vs. Return on Investment.

“ You generally hear that what a man doesn't know doesn't hurt him, but in business what a man doesn't know does hurt.” E. St. Elmo Lewis

Asset Value too High vs. Return on Investment (ROI) When Selling a Business

As a reminder, because buyers require a ROI, businesses are ordinarily valued as a multiple of their Seller’s Discretionary Earnings (SDE). In other words, the SDE generated by the business needs to be enough to accomplish three things: (1) service the debt on the acquisition; (2) enable the new owner to pay himself a reasonable salary; and (3) have some profit left over for working capital and reinvestment needs.

If a business has hard assets valued in excess of the Enterprise Value (fair market value of the business as a going concern) as computed from applying the appropriate multiple to its SDE, it may not be salable as a going concern. A liquidation sale of individual assets at fair market value may provide more funds for a seller than its Enterprise Value (based on SDE).

An example of a business that cannot be sold due to the high value of its assets

John Smith, who owned a capital-intensive manufacturing business, recently invested a total of $500,000 in three new large pieces of equipment and took on $400,000 of additional debt. Two months later he was killed in an automobile accident. One year before his death (prior to his recent $500,000 investment), John had a business evaluation that determined his business had $160,000 in Seller’s Discretionary Cash Flow and the business was valued at $450,000.

After his death, his wife decided to sell the business to a senior employee who was earning $95,000 per year and had sufficient financial capability. In the most recent year, the company again produced about $160,000 in Seller’s Discretionary Cash Flow, so the Enterprise Value was still in the area of $450,000.

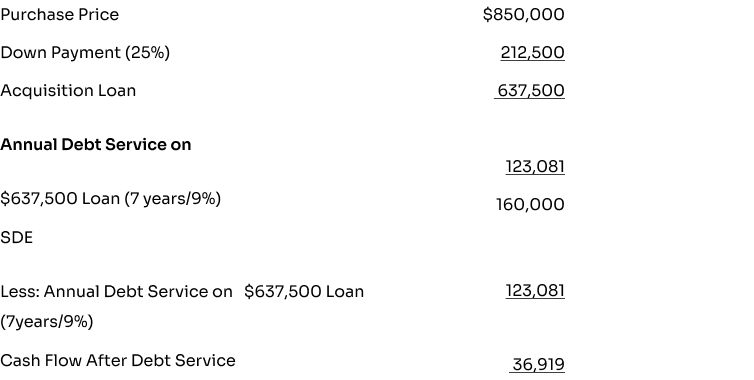

But his wife felt the business was worth much more because of the recent $500,000 investment in equipment. A professional equipment appraiser was hired and the total fair market value of the individual assets was $850,000 ($450,000 of previously owned assets and $400,000 for the newly acquired equipment). Based on the $850,000 price tag, the senior employee (and any other prospective buyer) can no longer afford to buy the business because the ROI is totally inadequate. Here’s proof:

It doesn’t make sense, does it? The prospective buyer is earning $95,000 as an employee. He’s not going to invest $212,500 as a down payment to be able to earn a salary of about $35,000 per year. Actually, with working capital and reinvestment needs, the prospective buyer probably couldn’t pay himself at all and may have to use out of pocket cash to fund the ongoing needs of the business. At a price tag of $850,000, this deal is not going to happen with the senior employee or any prospective buyer.

The wife’s best option, unless she wants to continue to run the business with an eye toward increasing the Enterprise Value by increasing the SDE, is to liquidate the individual assets by selling them individually over a period of time, or at an auction (which may not enable her to obtain fair market value).

A similar example, where extremely valuable real estate is owned by the Seller, will be provided in the next newsletter.

It's important to know the Enterprise Value of your business

Especially when considering your exit, it pays to know the Enterprise Value as well as the fair market value of your assets if you simply liquidate. In most cases, Enterprise Value will exceed Asset Liquidation Value, but there are numerous and varied exceptions, especially if your business is in a capital-intensive industry or you have extremely valuable real estate.

As your exit time frame approaches, to maximize the funds you receive at closing it may be best to minimize large capital investments that require financing. Typically, the Seller transfers all assets to the buyer unencumbered, which means the Seller must pay off all loans from the proceeds of the sale.

Do you know if your company’s Enterprise Value exceeds its Asset Liquidation Value?

"There are two primary choices in life: to accept conditions as they exist, or accept the responsibility for changing them." Denis Waitley

Overcome the Power of Inertia

Overcome the Power of Inertia and call a business broker for a free consultation. Many brokers offer no-charge, no-obligation evaluations of small businesses. They can provide a broker opinion of value and help you identify obstacles to a successful sale as well as opportunities for improvement to increase the value of your business. That is a great way to start planning for a successful and profitable exit from your business.